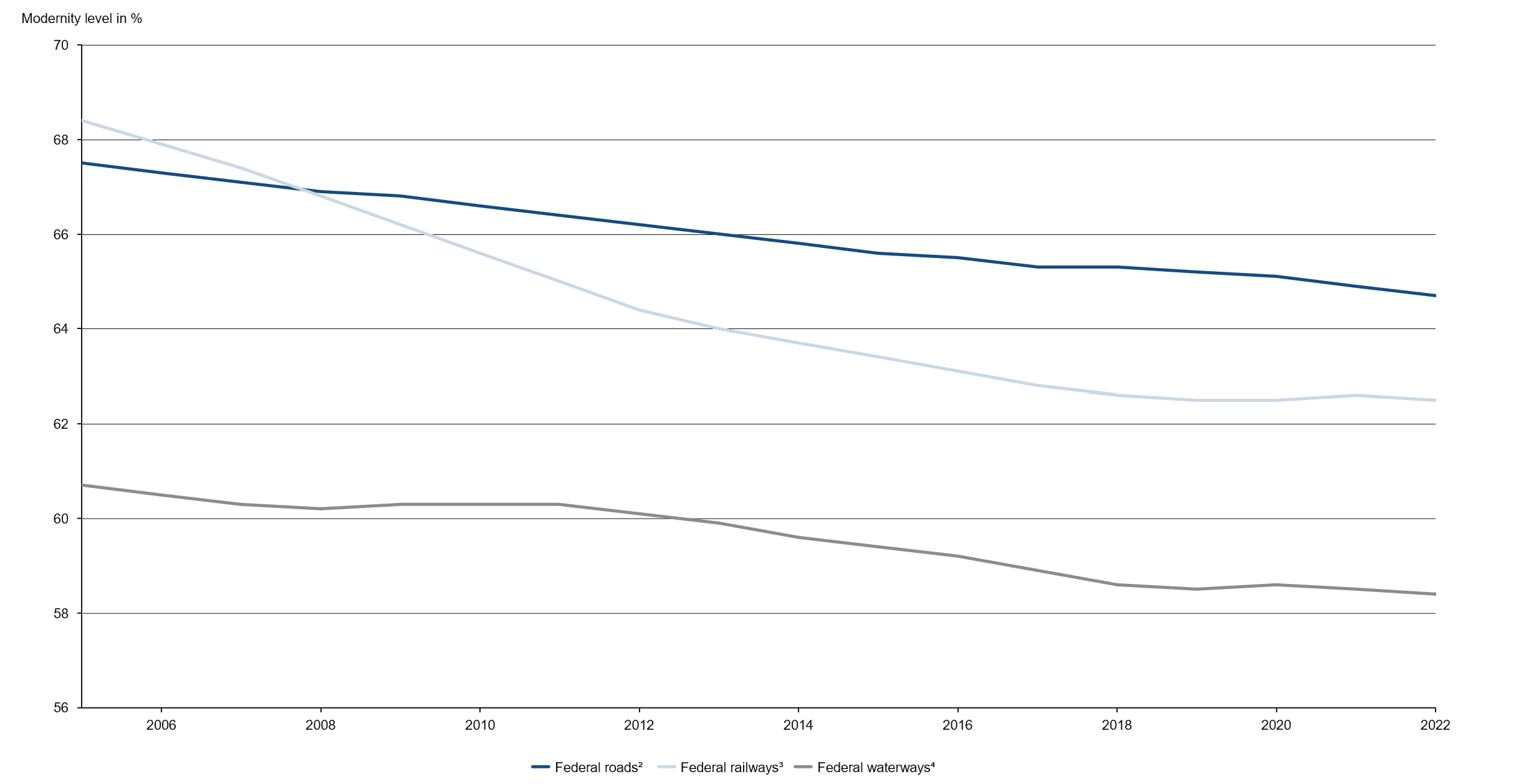

As a central economic hub in Europe, Germany depends on efficient and reliable transport routes. Years of underinvestment have left roads, railways, and waterways in poor condition (Figure 1). To reverse this trend, the federal government has launched the EUR 500 billion Special Fund for Infrastructure and Climate Neutrality (SVIK), which will address infrastructure deficits, support long-term competitiveness, and create opportunities for companies to drive the sector’s transformation.

Figure 1: Declining modernity levels1 due to low infrastructure investments

1 Net fixed assets in relation to gross fixed assets, year-end stock excluding land acquisition. Provisional values 2020–2022.

2 Excluding administration.

3 Traffic routes; until 2012 Deutsche Bahn Group. Data basis changed in 2005. From 2013, railway system group.

4 Up to the sea border.

Sources: Federal Ministry of Transport, GCEE

A network under pressure

The 2023 Transport Investment Report paints a bleak picture:

- Almost 20% of motorways (Autobahnen) and nearly 30% of highways (Bundesstraßen) exceed the warning threshold for road surface condition.

- One in three motorway bridges and one in seven federal highway bridges require refurbishment.

- Over half of railway bridges are in poor condition, alongside outdated signal boxes and tracks.

- Waterways are even older, with locks and weirs averaging more than 65 years.

The result is mounting congestion, reduced reliability and a drag on economic activity, largely due to decades of underinvestment and a backlog of maintenance and new construction projects.

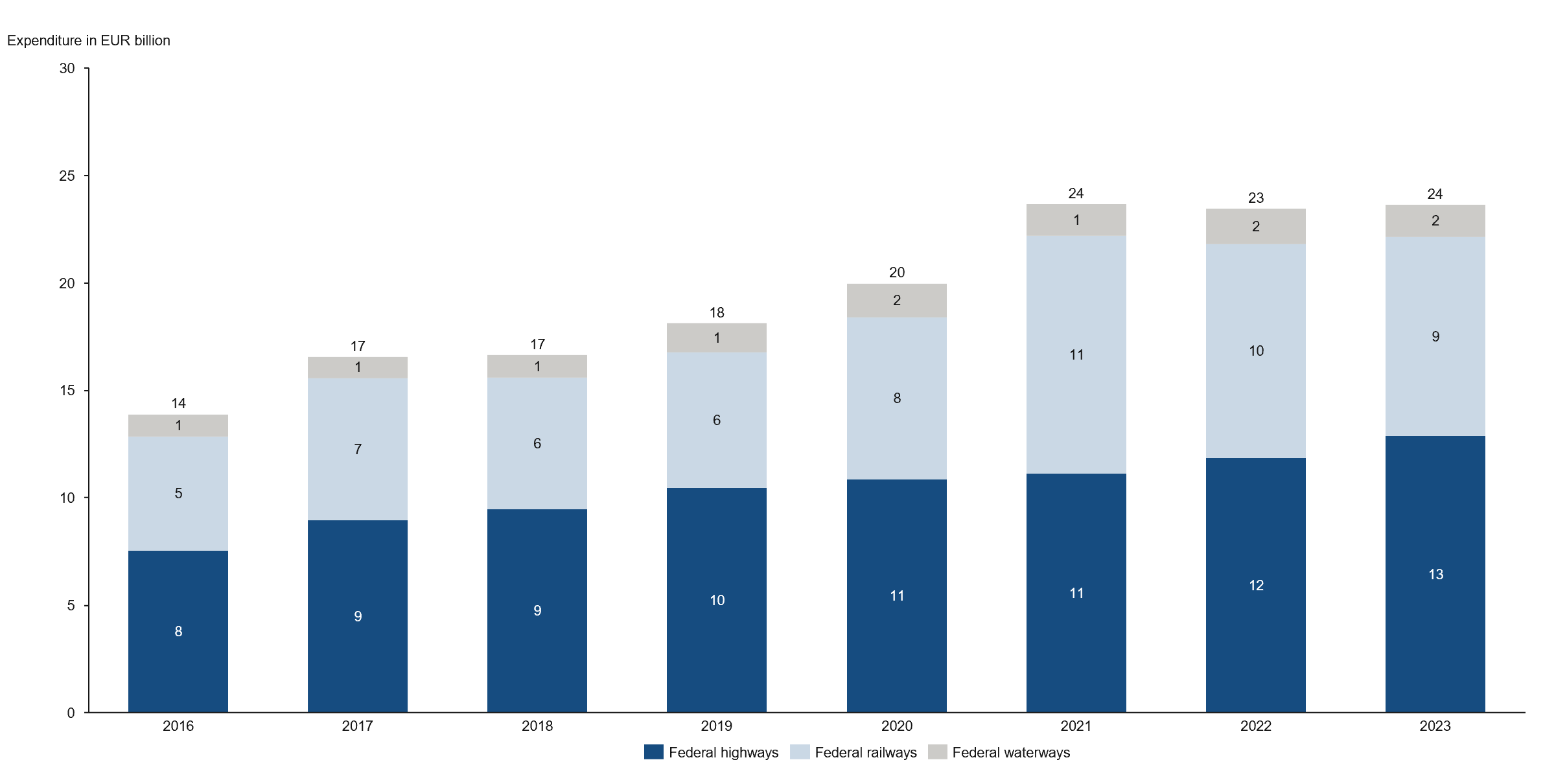

Investment trends and gaps

Federal spending on transport infrastructure stagnated after the global financial crisis but began rising again in 2016, with rail and roads seeing the biggest gains (Figure 2). However, rising construction costs have offset much of the increase, leaving capital spending below the levels required to meet demand.

Figure 2: Rail and road are the drivers of increased transport expenditure1 since 2016

1 Price-adjusted transport expenditure with the average development of the construction price indices in building construction and civil engineering.

2 As part of a comprehensive modernisation of the budget and accounting system in 2016, administrative services and special assets were reclassified to other transport expenditure.

Sources: Federal Ministry of Transport, GCEE

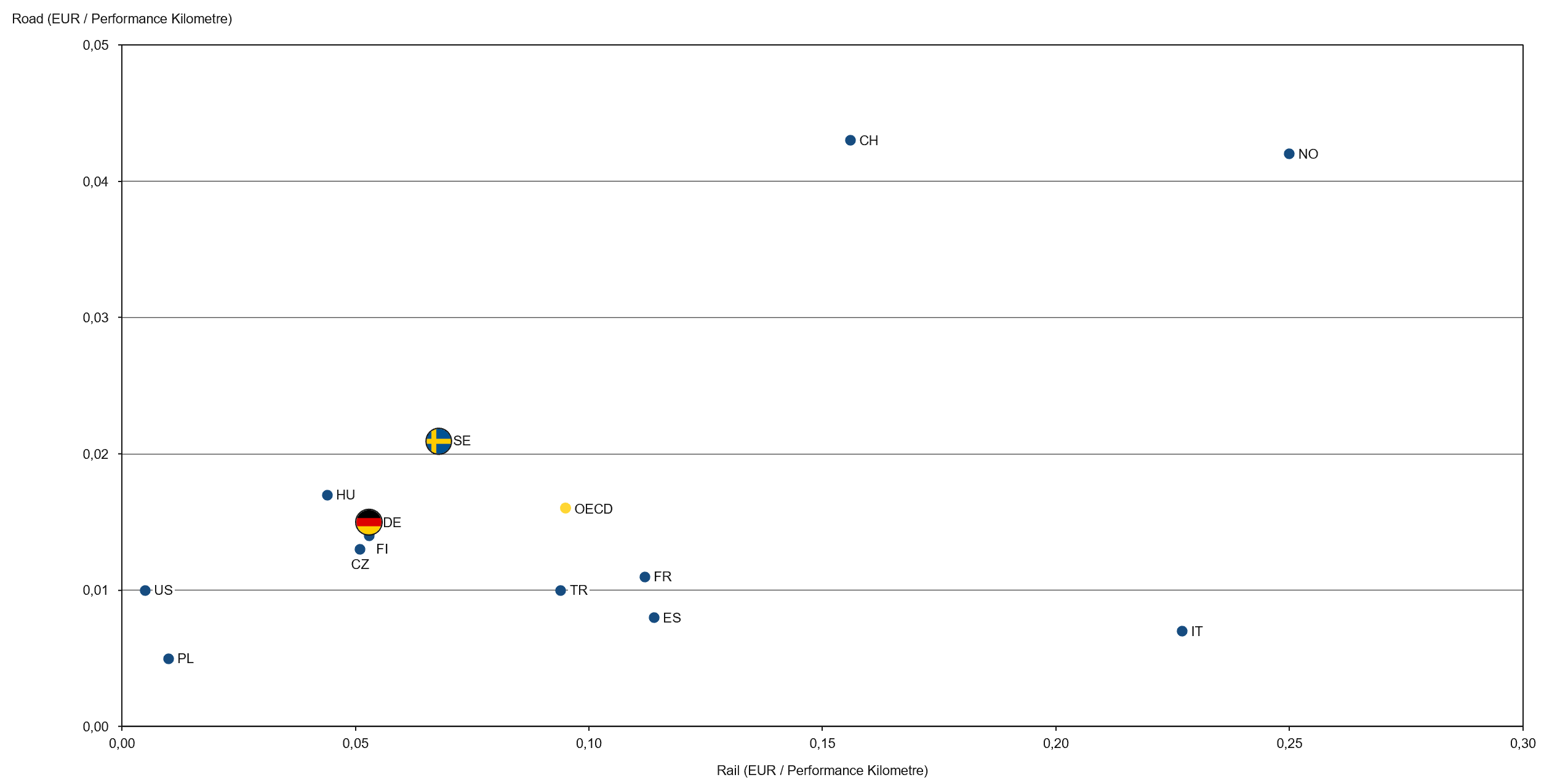

In international comparison, Germany sits mid-table among OECD countries (Figure 3). In 2020, public spending per kilometre of transport performance was about 1.5 cents for road and 5 cents for rail, which is well below levels in Norway, Switzerland and Sweden.

Figure 3: Infrastructure investments 1 per performance kilometre2 in 2020 – international comparison3: Germany’s road and rail investments below average

1 Infrastructure investments include expenditure on new construction and improvements to existing transport routes.

2 Performance kilometres include freight in tonne-kilometres and passenger transport performance in passenger-kilometres

3CH-Switzerland, CZ-Czechia, DE-Germany, ES-Spain, FI-Finland, FR-France, HU-Hungary, IT-Italy, NO-Norway, PL-Poland, SE-Sweden, TR-Turkey, US-USA.

Sources: OECD, GCEE

Rising demand

Traffic volumes are set to grow further. By 2040, passenger travel is expected to increase by 8% compared with 2019, while freight transport is expected to rise by 31%. The foreseeable growth in transport volumes will place increasing pressure on western states and on transit routes from Eastern and Southeastern Europe.

Path to decarbonisation

Transport is responsible for around 20% of Germany’s greenhouse gas emissions, most from road traffic. Shifting motorised passenger travel to rail, public transport, cycling, and walking can cut emissions, but freight will remain truck-dominated due to rail capacity constraints and separate markets for road and rail freight transport. The key to decarbonising freight lies in electrifying powertrains and building charging infrastructure along major routes.

Cutting red tape

Infrastructure projects are often delayed by lengthy planning and approval procedures. In federal road projects, 85% of the total time is consumed before construction even begins. The forthcoming Infrastructure Future Act (Infrastruktur-Zukunftsgesetz) aims to halve approval times by declaring major rail projects of overriding public interest, easing species protection rules, and simplifying bridge upgrades.

Investment outlook

Transport Minister Patrick Schnieder has announced EUR 166 billion in government infrastructure spending over the next five years, a sharp increase from EUR 102 billion between 2020–2024.

Planned allocations:

- Highways: EUR 52 billion

- Railways: EUR 107 billion

- Waterways: EUR 8 billion

In 2025 alone, EUR 33.5 billion is available, with EUR 11.7 billion from SVIK focused on motorway bridge modernisation and rail renovation and digitalisation.

|

|

2025 |

2026 |

2027 |

2028 |

2029 |

Total |

|

|

- in EUR billion - |

|||||

|

Transport investments |

33.5 |

33.7 |

33.1 |

33.3 |

32.8 |

166.3 |

|

Federal trunk road |

10.0 |

10.3 |

31.6 |

52.0 |

||

|

2.5 |

2.5 |

7.5 |

12.5 |

||

|

Federal railways |

21.8 |

21.9 |

63.1 |

106.8 |

||

|

9.2 |

18.8 |

52.9 |

80.9 |

||

|

Federal waterways |

1.6 |

1.5 |

4.5 |

7.6 |

||

Table 1: Key figures for transport investments contained in federal budget 2026

Source: Federal Ministry of Transport

Opportunities for Swedish companies

|

|

Opportunity |

|

Motorway bridges |

Structural repairs and reinforcement using sustainable construction materials (e.g. recycled asphalt) and durable steel |

|

Advanced inspection and monitoring solutions, including IoT sensor systems, predictive maintenance platforms, and digital twins |

|

|

Railways |

Modernisation and renewal of tracks and bridges with sustainable materials |

|

Deployment of advanced digital signalling and safety systems, sensor technologies, and rollout of the European Rail Traffic Management System (ERTMS) |

|

|

Rail electrification projects with green and energy-efficient technologies |

Next in the series

Our next post will cover Germany’s push in the deployment of connectivity infrastructure, with a focus on the expansion of nationwide high-speed broadband as well as in the digitalisation of public services.

Get in touch

Business Sweden supports companies entering Germany’s infrastructure and climate sectors. For advice on market entry, funding frameworks, or competitive bidding, please contact Johan Holmlund.

References

- Federal Court of Audit (2025), Slow refurbishment of dilapidated federal trunk road bridges. Special report retrieved on 22/08/2025 from Brückenmodernisierung

- Federal Ministry for Economic Affairs and Energy (2020), Public infrastructure in Germany: Challenges and need for reform, retrieved on 21/08/2025 from Öffentliche Infrastruktur in Deutschland: Probleme und Reformbedarf

- Federal Ministry of Transport (2025), EUR 166 billion for transport infrastructure. Press release retrieved on 20/08/2025 from BMV - Schnieder: 166 Milliarden für Verkehrsinfrastruktur

- Federal Ministry of Transport (2025), The 2026 budget strengthens our infrastructure. Press release retrieved on 20/08/2025 from BMV - Haushalt 2026 stärkt unsere Infrastruktur

- Federal Ministry of Transport and Digital Infrastructure (2016), The 2030 Federal Transport Infrastructure Plan.

- Federal Ministry of Transport and Digital Infrastructure (2024), Transport Forecast 2040, retrieved on 21/08/2025 from www.bmw.de

- Federal Ministry of Transport and Digital Infrastructure (2023), Transport Investment Report 2023 reporting year, retrieved on 26/08/2025 from www.bmw.de

- German Council of Economic Experts (2025), Spring report 2025