Taiwan's beauty enthusiasts, known for their penchant for innovation and sustainability, create an ideal testing ground for cutting-edge products. Customer-centric values and a blend of tradition and creativity make Taiwan's beauty market a compelling space for Swedish brands. Specifically, those ready to take on a mature market with a knowledgeable consumer-base. In this article, we will look at the overall beauty industry in Taiwan, and deep dive into the segments of skincare, haircare, and cosmetics.

Consumers desire sustainable beauty for the skin, the body, and the planet

Beneath the market trends lies a nuanced understanding of consumer needs within the beauty industry. Taiwanese consumers are increasingly seeking innovation and diversification, favoring brands that offer a full range of products covering all needs. The industry is responding by providing a wide range of products across different categories, encouraging customers to explore products and build loyalty.

Clean beauty, with a focus on sustainability, is at the forefront of consumer priorities. The demand for cleaner and healthier products is being met by brands using formulations of natural, mild, and vegan ingredients. Recyclable packaging is no longer a luxury but an essential feature that aligns with consumers' commitment to sustainability.

Skincare consumers are increasingly aware of what they want in their products

Consumers within the skincare segment are increasingly aware of how products affect not only their skin, but also the environment. Sun protection, hydration, and anti-aging solutions are top priorities. Ingredient education is also crucial as consumers are now choosing products with natural, sustainable, and vegan ingredients.

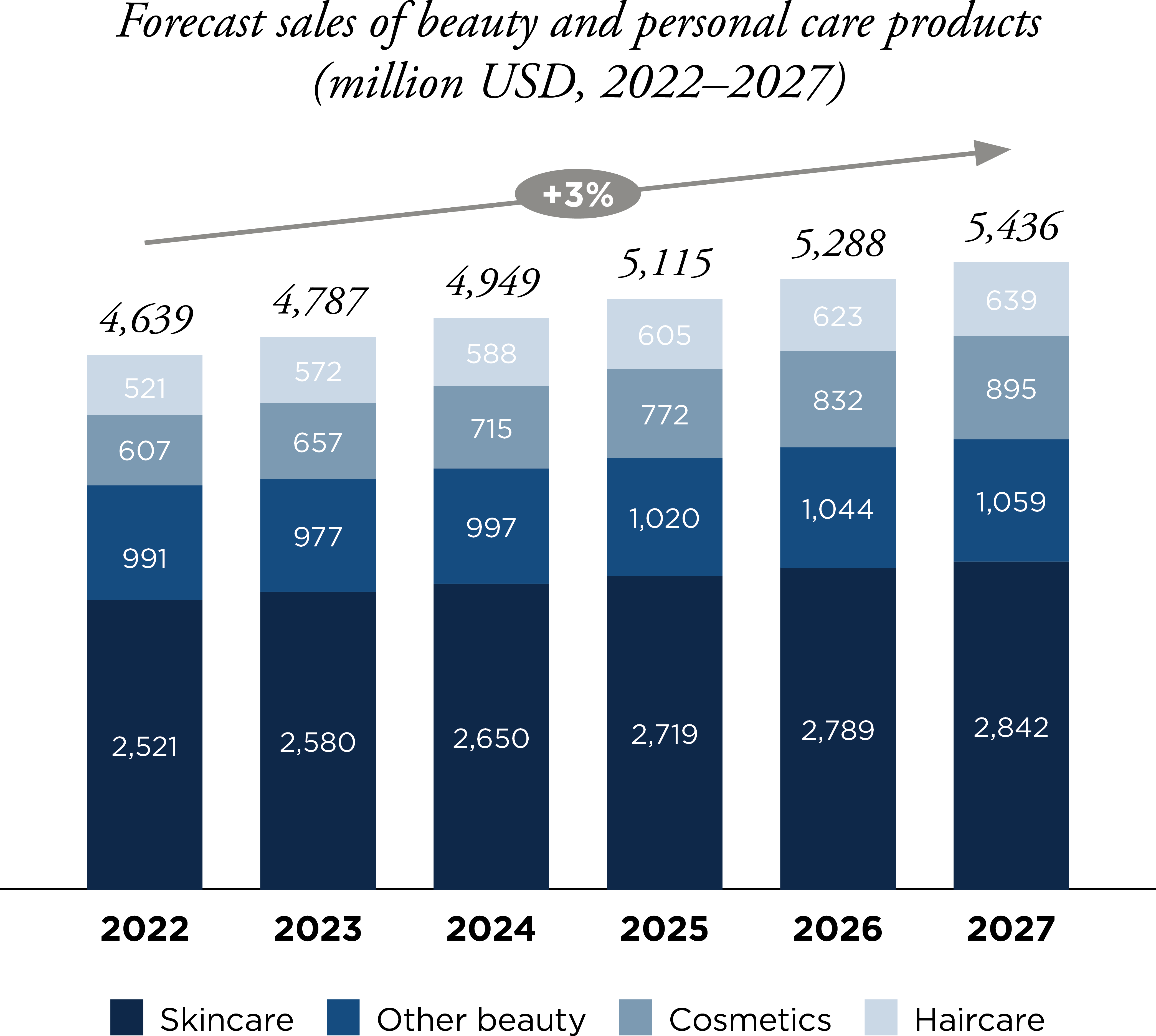

It is projected that by 2027, a Compound Annual Growth Rate (CAGR) of 2.4 per cent will be achieved in the skincare sector, highlighting steady and sustainable growth. Within the skincare segment in 2022, skincare sets claimed the spotlight, contributing significantly to the industry's success. Projections for 2027 anticipate an impressive eight per cent growth for skincare sets, propelling the overall skincare category to a market value of USD 109.8 million. This surge is indicative of Taiwanese consumers' increasing emphasis on skincare routines and their demand for comprehensive solutions catering to diverse skin types.

By 2027, the haircare segment is projected to experience the biggest growth

The dynamic nature of the haircare segment, driven by innovations in formulations and an increased focus on targeted solutions has led to a CAGR projection of eight per cent by 2027. The haircare segment is the segment with the highest expected growth rate within the beauty industry. Consumers are specifically asking for specialized scalp care products that address concerns related to hair and scalp health. The interest in waterless products, such as bars, is also increasing due to sustainability concerns around packaging, aligning with the industry's commitment to eco-friendly practices.

In 2022, conditioners and treatments were the best-performing category in the haircare segment and projections for 2027 suggest a notable seven per cent growth for this category, with the haircare segment expecting to reach a value of USD 10.3 million. This growth underscores Taiwanese consumers' prioritization of both skin- and haircare.

Premium makeup is in high-demand post-Covid

There is steady growth projected for the cosmetics sector with an expected CAGR of 3.9 per cent by 2027 highlights the enduring appeal of cosmetics. Specifically, facial makeup is set to see the strongest growth, with consumers seeking premium products for a luxurious experience. The convergence of skincare and cosmetics is evident in the growing demand for products that offer multifunctional benefits.

Colour cosmetic sets took center stage in 2022, emerging as the best-performing category. After years of consumers hiding their face behind masks and not caring about makeup, they are now back wanting more. The cosmetic segment is projected to grow by five per cent, reaching USD 8.7 million by 2027.

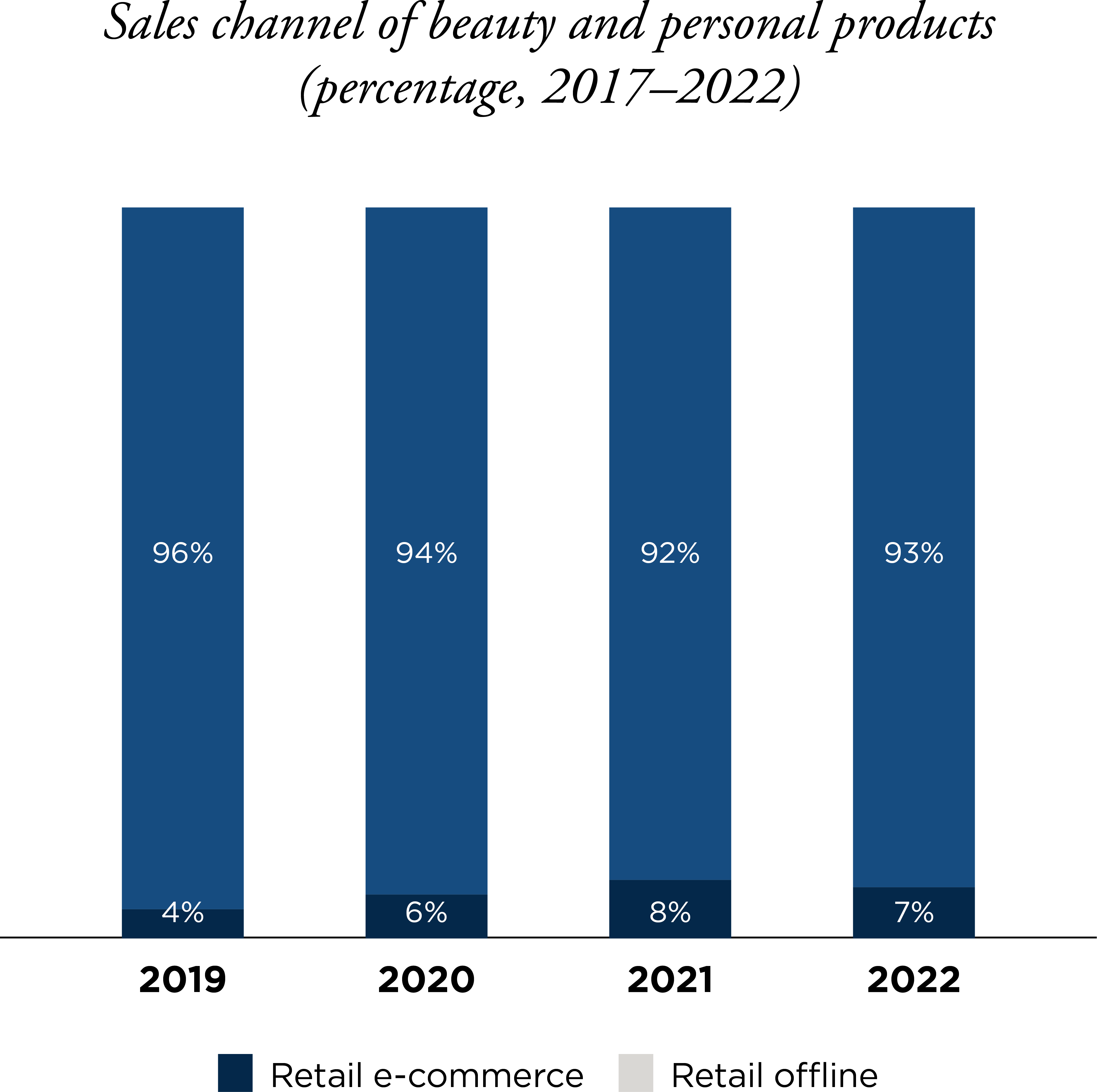

The desire to touch, feel, and try before you buy

While online shopping experienced a slight growth during the pandemic, offline channels continue to dominate. Physical stores remain crucial as consumers value the ability to see, touch, and try products.

Nevertheless, e-commerce should not be dismissed; it should be viewed as a promising opportunity. The anticipated CAGR for the overall e-commerce market in Taiwan is projected to be 6.66 per cent between 2023 and 2027.

A significant trend in the industry has been the widespread adoption of OMO by many beauty brands. This integration of online and offline channels aims to create a cohesive and immersive customer experience while enhancing brand visibility.

Emphasizing customer service is a common thread binding together both online and offline channels. Taiwanese consumers, whether shopping virtually or in-store, expect a high level of customer service. Online, this expectation translates into solutions such as the use of artificial intelligence for trying on products virtually. Brands that leverage technology to provide personalized and interactive experiences online are gaining favor with consumers.

Small players are gaining traction and the legal landscape is showcasing positive developments

In the competitive arena of Taiwan's beauty industry, L'Oréal continued to assert its dominance in 2022, maintaining its position as the leading player in terms of value. L'Oréal stood as the sole player holding a double-digit value share. Procter & Gamble also exhibited a rising value share in 2022, propelled by the strength of its brands, including SK-II, Pantene, and Pert, among others.

Interestingly, the landscape witnessed a notable ascent of smaller brands. Brands that are on the rise are mostly brands that have an emphasis on sustainability. Taiwan’s beauty market is now an environment where both industry giants and emerging, purpose-driven brands play an important role for consumers.

Regarding the regulatory landscape, Taiwan has aligned its cosmetics regulations with those of the EU, favoring legal distributors and limiting parallel importation. In 2019, the government revised the Cosmetic Hygiene and Safety Act, requiring cosmetics manufacturers and importers to register and maintain detailed product files. Additionally, it mandates clear labeling of product name, purpose, and ingredients on cosmetic packaging, aiming to enhance consumer rights and access to product information.

The Taiwanese beauty market welcomes smaller, eco-friendly companies

Are you considering Taiwan as the next step in your expansion journey? We have identified key challenges and opportunities to consider when entering the Taiwanese beauty market.

- Adaptability is a key factor for success in the current beauty market. Brands that can navigate the changing landscape and offer a blend of online and offline experiences, are more likely to thrive. This adaptability extends to incorporating technological advancements that enhance the customer journey, from virtual try-ons to personalized recommendations.

- The increase of the sustainability focus within the beauty industry presents a fast-track for companies that are already seeing clean beauty and sustainability as the core of their brand.

- Companies needs to be aware of the regulative landscape for beauty products within registration, labelling and advertising - especially if claiming any health benefits. Companies should advise local partners on best practices to avoid any issues in this field.

- Smaller, more niche brands, are gaining traction. Swedish companies that have deep knowledge within clean and innovative products have an opportunity to sway consumers from larger more generic brands.

Business Sweden will help you connect with local business opportunities

We recommend finding a local business partner that has knowledge of the market. A Taiwanese partner can identify the best way to introduce your brand to the local market, as well as pinpointing appropriate distribution and marketing channels. When considering cooperation with a Taiwanese beauty company, we recommend determining clear criteria and expectations as well as defining the needed expertise of your local counterpart.

Business Sweden has been conducting partner searches and market introductions in Taiwan since the early 1990s and we have a broad understanding of the general market as well as of the local beauty industry. We are more than happy to assist you and your company with market information and strategic consultation to ensure an effortless and successful market entry.