Over the years marked by the COVID-19 pandemic and Russia’s invasion of Ukraine, Germany’s economy has experienced prolonged stagnation. Elevated energy prices and declining purchasing power have weighed on growth, while structural challenges such as demographic change, administrative burdens, and mounting global competition have added further pressure.

At the same time, decades of stringent fiscal discipline and a focus on balanced budgets have come at the expense of essential public investment in transport infrastructure, defence, and education. This has led to an ageing capital stock, capacity constraints in key services, and concerns over Germany’s ability to meet future demands in digitalisation, climate action, and security.

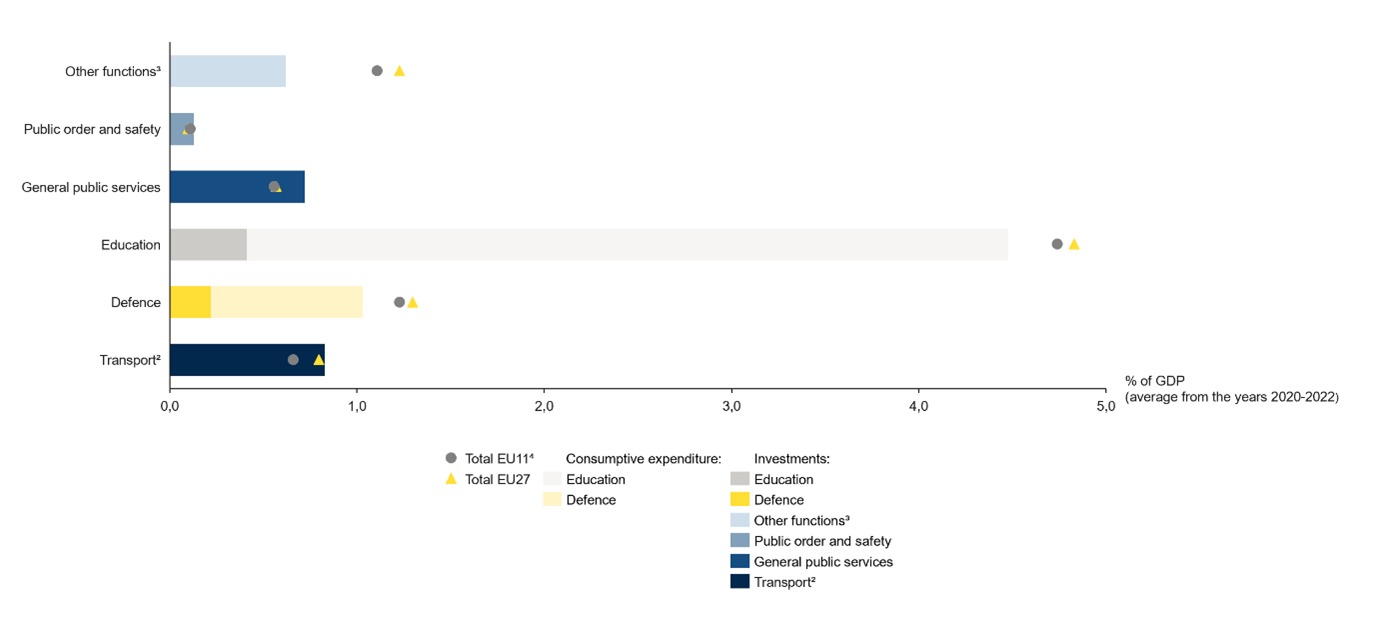

According to the German Council of Economic Experts (GCEE), Germany has consistently invested a smaller share of GDP in future-oriented public functions than most other EU countries since the early 2000s (Figure 1). Public spending is classified as either consumptive expenditure, which covers the ongoing provision of public services, or investment expenditure, which creates assets whose benefits accrue over time.

Figure 1: Future-oriented public spending¹ lower in Germany than the EU average

1 Gross investment (and other non-investment expenditure on defence and education) according to the Classification of the Functions of Government (COFOG).

2 Gross investment in the transport sector is only reported by the Federal Statistical Office for Germany from 2000 onwards and by Eurostat for the EU27 from 2001 onwards. Prior to this, gross investment in transport is approximated using the share of gross investment in economic affairs.

3 Economic affairs excluding transport; environmental protection; housing and community amenities; recreation, sport, culture, and religion; health; social protection.

4 Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain. Data from 2002 onwards.

Sources: Eurostat, Federal Statistical Office, GCEE

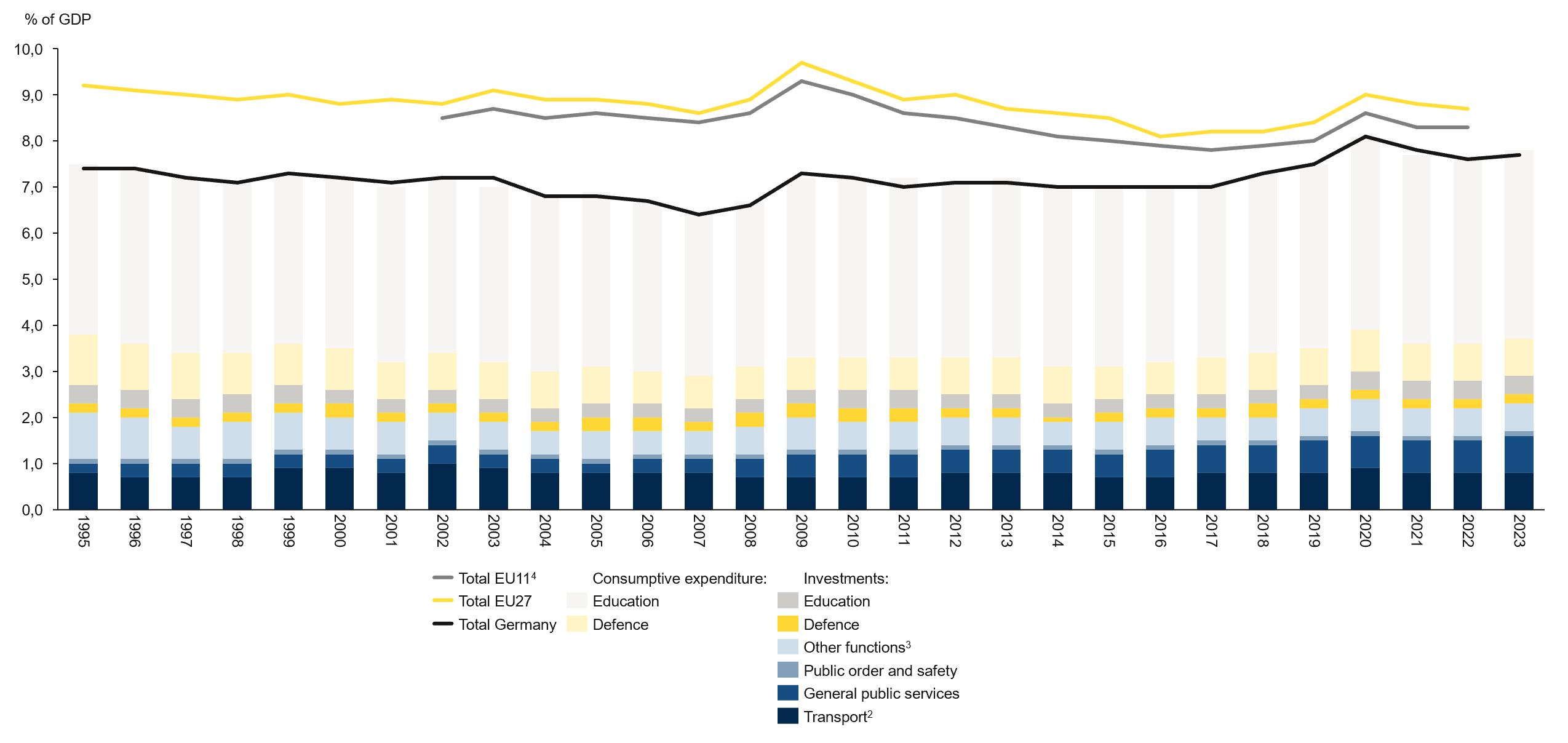

The gap is especially pronounced in education and defence, where spending from 2020 to 2022 fell well below the EU average (Figure 2).

Figure 2: Future-oriented public spending¹ lower in Germany than the EU average, especially in defence and education

1 Gross investment (and other non-investment expenditure on defence and education) according to the Classification of the Functions of Government (COFOG).

2 Gross investment in the transport sector is only reported by the Federal Statistical Office for Germany from 2000 onwards and by Eurostat for the EU27 from 2001 onwards. Prior to this, gross investment in transport is approximated using the share of gross investment in economic affairs.

3 Economic affairs excluding transport; environmental protection; housing and community amenities; recreation, sport, culture and religion; health; social protection.

4 Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain. Data from 2002 onwards.

Sources: Eurostat, Federal Statistical Office, GCEE

In response, the new federal government has launched a comprehensive “investment offensive”. Chancellor Friedrich Merz pledged to “invest and reform to ensure that Germany remains stable, secure, and economically stronger. Europe, as well, can rely on Germany.” Core priorities include strengthening national defence, modernising critical infrastructure, and laying the groundwork for sustainable, long-term growth.

To finance this agenda, the outgoing Bundestag enacted constitutional changes to relax the “debt brake” (Schuldenbremse) and create a EUR 500 billion Special Infrastructure and Climate Neutrality Fund. The reform, supported by the votes of the conservative alliance (CDU/CSU), the Social Democrats (SPD) and the Greens, and approved by the Bundesrat on 21 March 2025, marks a decisive shift from two decades of fiscal conservatism.

Key reforms and budgetary measures

(1) EUR 500 billion Special Fund for infrastructure: Independent of the core federal budget and exempt from the debt brake, this 12-year fund allocates:

- EUR 300 billion for national infrastructure (transport, energy, healthcare, education, digitalisation, R&D).

- EUR 100 billion for the Climate and Transformation Fund (renewables, hydrogen, climate-friendly industry, building renovation).

- EUR 100 billion for state-level projects, distributed via the Königsteiner Schlüssel, which considers both the federal state’s tax revenue and population size.

(2) Relaxation of the debt brake: Germany’s constitutional debt limit of 0.35 per cent of GDP will no longer apply to defence spending above 1 per cent of GDP, enabling additional borrowing to strengthen military capabilities. With GDP at EUR 4.3 trillion in 2024, this exempts defence and security spending above EUR 43 billion annually.

(3) Increased fiscal autonomy for federal states: The “Länder” can now run annual deficits of up to 0.35 per cent of their GDP, amounting to roughly EUR 15 billion in new borrowing capacity for targeted regional investments.

Financial investments

In June 2025, the cabinet adopted the second draft of the 2025 federal budget, along with benchmark figures to 2029 and the draft law establishing the Special Fund (SVIKG). Finance Minister Lars Klingbeil announced record investment of over EUR 115 billion in 2025, representing a 55 per cent increase compared to 2024, with a total of EUR 120 billion expected by 2029. According to Klingbeil, these funds will launch a comprehensive modernisation programme aimed at improving schools, childcare facilities and hospitals, upgrading railways, bridges and roads, and advancing climate action and digital technologies. Significant resources will also be directed towards strengthening both internal and external security.

|

|

As-Is 2024 |

Second government draft 2025 |

Fiscal plan |

|||

|

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

|

|

- in € billion - |

|||||

|

Expenditure |

474,2 |

503,0 |

519,5 |

512,7 |

550,4 |

573,8 |

|

‒ Year-on-year change in % |

X |

6,1 |

3,3 |

-1,3 |

7,4 |

4,3 |

|

Revenue |

440,8 |

421,2 |

430,2 |

425,3 |

434,7 |

447,8 |

|

‒ Of which: tax revenue |

375,0 |

386,8 |

383,8 |

400,6 |

412,3 |

423,9 |

|

Net borrowing in the core budget |

33,3 |

81,8 |

89,3 |

87,5 |

115,7 |

126,1 |

|

Special funds |

17,2 |

61,3 |

83,4 |

84,4 |

58,0 |

59,4 |

|

‒ Special Fund for Infrastructure and Climate Neutrality (SVIK¹) |

- |

37,2 |

57,9 |

57,0 |

58,0 |

59,4 |

|

‒ Special fund for the Bundeswehr (SV BW) |

17,2 |

24,1 |

25,5 |

27,5 |

- |

- |

Table 1: Key figures contained in the second government draft of the 2025 federal budget and the benchmark figures to 2029

1 SVIK from 2026: Status of internal work planning. The share allocated to the federal states (EUR 100 billion) has been evenly distributed over 12 years (technical assumption).

Source: Federal Ministry of Finance

The Special Fund for Infrastructure and Climate Neutrality will only finance “additional” investments, with a minimum ratio of 10 per cent relative to federal budget spending. Valid until 31 December 2036 and retroactive from 1 January 2025, it will disburse EUR 37.2 billion in 2025 and authorise EUR 84.8 billion for future years. Planned expenditures are organised into seven main categories (Table 2).

|

Category |

2025 Allocation |

Future Commitments |

|

|

1. |

Transport infrastructure |

EUR 11.7 billion |

EUR 69.4 billion |

|

1.1. |

Modernisation of motorway bridges |

EUR 2.5 billion |

EUR 6.5 billion |

|

1.2. |

Implementation of European |

EUR 1.6 billion |

EUR 8.7 billion |

|

1.3. |

Maintenance of federal railway network |

EUR 7.6 billion |

EUR 62.9 billion |

|

2. |

Hospital infrastructure |

EUR 1.5 billion |

— |

|

3. |

Energy infrastructure |

EUR 855.2 million |

EUR 409.8 million |

|

3.1. |

LNG terminals (FSRU, etc.) |

EUR 835 million |

EUR 30 million |

|

3.2. |

Energy security (Schwedt refinery) |

EUR 20.2 million |

EUR 379.8 million |

|

4. |

Education and childcare infrastructure |

Not yet allocated |

— |

|

5. |

Research and development |

EUR 472 million |

EUR 187 million |

|

5.1. |

High-tech agenda |

EUR 398 million |

EUR 187 million |

|

5.1.1. |

Artificial intelligence |

EUR 100 million |

— |

|

5.1.2. |

Quantum technologies |

EUR 95 million |

— |

|

5.1.3. |

Biotechnology & life sciences |

EUR 142.4 million |

— |

|

6. |

Digitalisation |

EUR 4.0 billion |

EUR 2.04 billion |

|

6.1. |

Broadband expansion |

EUR 2.9 billion |

EUR 1.8 billion |

|

6.2. |

Digital government modernisation |

EUR 263 million |

EUR 236.8 million |

|

7. |

Housing construction |

EUR 327 million |

EUR 1.74 billion |

|

7.1. |

Climate-friendly new buildings |

EUR 20.5 million |

EUR 643.5 million |

|

7.2. |

Climate-friendly construction |

EUR 243.5 million |

EUR 1.1 billion |

Table 2: SVIK planned expenditures are divided into seven main categories (as of 31.07.2025)

Disclaimer: Since some funds have yet to be allocated, the distribution shown does not add up to the proposed EUR 37.2 billion for 2025 and EUR 84.8 billion in future commitments. The remaining funds will be assigned based on future negotiations within the governing coalition. The subcategories do not necessarily sum to the full amount either, as some funds remain unallocated or are spread across other areas.

Source: German Bundestag, Federal Ministry of Finance

Economic impact

The German Institute for Economic Research (DIW Berlin) forecasts GDP growth of 0.3 per cent in 2025 and 1.7 per cent in 2026, marking an upward revision from earlier estimates. The fund is expected to contribute around 0.8 percentage points to 2026 growth. This improved outlook reflects growing confidence in the fund’s capacity to drive domestic demand, stimulate investment, and support the broader recovery of the German economy.

While full effects will take time due to lengthy planning and implementation cycles, the programme signals a shift from austerity toward targeted investment in resilience. According to DIW President Marcel Fratzscher, the decisive factors for Germany’s recovery will depend on restoring trust and optimism domestically.

Opportunities for Swedish companies

While public investment alone will not secure Germany’s long-term competitiveness, it is a crucial catalyst for attracting private investment. Improved planning frameworks, location advantages, and clear investment signals can help mobilise funding and spur economic activity.

The infrastructure and climate fund creates substantial opportunities for international collaboration. Swedish firms, leaders in green technology, sustainable construction, and digital innovation, are well positioned to engage in priority sectors (Table 3). Long-standing bilateral ties and Sweden’s reputation for high-quality, climate-friendly solutions further strengthen the case for cooperation.

|

Sector |

Opportunity |

|

Transport infrastructure |

The EUR 500 billion infrastructure fund aims to revitalise Germany’s infrastructure, with a strong focus on the transport sector. It presents substantial opportunities for companies involved in the construction of railways, motorways, and related projects. In addition, the fund will support the nationwide expansion of electric vehicle (EV) charging infrastructure, invest in battery production and R&D, and provide subsidies for EV manufacturing and related infrastructure. |

|

Digital infrastructure |

Germany has lagged in broadband and 5G deployment, affecting economic growth and the pace of digital transformation. The fund will support nationwide rollout of fibre-optic networks and expansion of 5G infrastructure to improve connectivity. |

|

Energy infrastructure |

A portion of the infrastructure fund will be allocated to the country’s green transition. This targeted investment will benefit the renewable energy sector and a broad array of environmental initiatives, accelerating the deployment of wind and solar power, energy storage solutions, and hydrogen infrastructure. |

|

Housing & Heating |

The fund also dedicates resources to strengthening housing infrastructure, with a strong focus on climate-friendly construction. These measures create attractive opportunities for companies specialising in green building and heating technologies, as well as in energy-efficient housing solutions. |

|

Defence & Security |

The exemption of defence spending from borrowing limits is expected to generate substantial new investment in military capabilities. This policy shift will directly benefit defence contractors and associated industries, as significant resources are allocated toward expanding and modernising Germany’s armed forces. |

Table 3: Key beneficiaries of the fiscal policy changes

Source: Business Sweden

EU procurement rules ensure Swedish companies full access to German public tenders, providing a strong entry point into projects backed by the fund (see more details here).

What to look for in the next edition

Our next blog post will examine Germany’s transport infrastructure, analysing decades of underinvestment, its impact on growth and mobility, and the pressing need for modernisation.

Get in touch

Business Sweden supports companies entering Germany’s infrastructure and climate sectors. For advice on market entry, funding frameworks, or competitive bidding, please contact Johan Holmlund.

References

- CDU, CSU & SPD (2025), Results of Coalition Talks between CDU, CSU und SPD.

- CDU, CSU & SPD (2025), Responsibility for Germany: Coalition Agreement, 21st legislative period.

- European Central Bank (2025), Macroeconomic Projections, retrieved on 307.2025 under https://www.ecb.europa.eu/press/projections/html/index.en.html

- Eurostat (2025), National accounts and GDP, retrieved on 307.2025 under https://ec.europa.eu/eurostat/statistics-explained/index.php?title=National_accounts_and_GDP

- Federal Ministry of Finance (2025), BMF-Monthly Report: April 2025, Berlin.

- Federal Ministry of Finance (2025), BMF-Monthly Report: July 2025, Berlin.

- Federal Ministry of Finance (2025), Federal Budget 2025, Berlin.

- German Bundestag (2025a), Draft law by the SPD and CDU/CSU amending the Basic Law (Articles 109, 115 and 143h), Printing Nr. 20/15096.

- German Bundestag (2025), Budget for 2025: Special Fund for Infrastructure and Climate Neutrality, hib 275/2025. Press release retrieved on 04.07.2025 under https://www.bundestag.de/presse/hib/kurzmeldungen-1098154.

- German Bundestag (2025), Draft act establishing the Special Fund for Infrastructure and Climate Neutrality, hib 286/2025. Press release retrieved on 07.2025 under https://www.bundestag.de/presse/hib/kurzmeldungen-1098824.

- German Council of Economic Experts (2025), Spring report 2025.

- German Institute for Economic Research (2025), German economy returning to growth path.