Sweden’s defence industry has a long-standing reputation for technology excellence with an ecosystem that today encompasses around 380 companies.

Of these, some 80 companies are exporters of advanced munitions and weapons, combat vehicles, surface vessels, software and surveillance systems and – most prominently perhaps in the eyes of industry outsiders – the Gripen fighter jet.

As global defence spending soared to a new high in 2025, a vast horizon of international opportunities has now opened up for Swedish suppliers. And the promising outlook goes well beyond Sweden’s world-class expertise in military equipment.

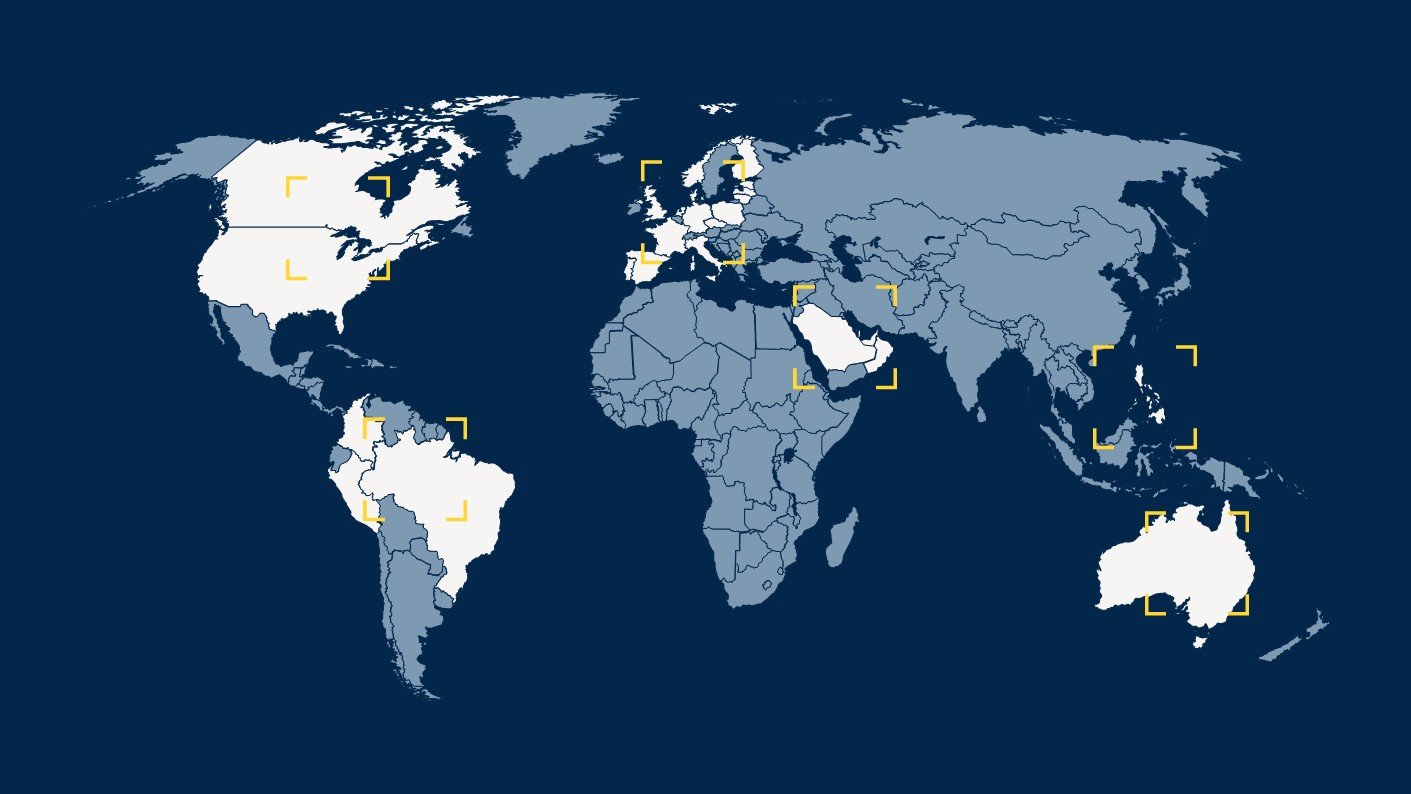

High-potential markets across the world for Sweden’s defence industry and suppliers of dual-use technologies.

UNLOCKING SWEDEN’S POTENTIAL IN DUAL-USE TECHNOLOGIES

Business Sweden’s defence industry experts work closely with both major players in the sector and a growing number of SMEs, helping them to navigate export control regulations, funding instruments, public tenders and cross-border collaboration opportunities.

A considerable share of these companies are specialists in technologies that, until recently, have largely focused on civilian applications. These span everything from drones, telecommunications and sensoring systems to cryptography, microorganisms and chemicals.

Today, the potential for so called “dual-use” items in the military domain is rapidly rising. An extensive feature published recently in Sweden’s leading business media outlet Dagens Industri (see article here in Swedish) highlighted the potential in the US in the following excerpt:

“The stage is set for major opportunities in the US for Sweden’s defence industry, especially in radar technologies, flight management systems, ammunition and automation systems.”

“In a broader perspective, dual use technologies such as space technologies can be used for the US’s new missile defence project Golden Dome,” the article continues.

MAPPING OPPORTUNITIES ACROSS FIVE CONTINENTS

The US government’s defence budget is expected to rise by 13 per cent next year. Large Swedish players such as Saab are already well-established in the market, having supplied (in partnership with BAE Systems) several Giraffe 4A and Sea Giraffe radar systems to the US Air Force and US Navy.

Besides this, the US Army has purchased Saab’s AT4 weapons system in a deal worth approximately SEK 4.7 billion.

Dagens Industri’s article, which mapped defence industry opportunities across five continents, also highlighted Canada as a promising market.

Peter Ekdahl, Business Sweden’s Vice President and Head of Region Americas, was interviewed and underscored that: “For many Swedish companies, the opportunities lie not in weapons systems but in areas such as surveillance, logistics and cyber security.”

Similarly, vast opportunities have opened up in Asia where military budgets are rapidly expanding. Companies such as Saab and Bofors are at the forefront of large negotiations, but many small, niche companies from Sweden are expanding their local market presence too.

Emil Akander, Business Sweden’s Vice President Asia-Pacific was quoted saying that: “The fact that these smaller companies are expanding proves the considerable size of defence budgets across Asia.”

The Giraffe 4A radar system by Saab was recently comissioned by the US Air Force

A NEW PARADIGM IN EUROPEAN SECURITY

In Europe, Swedish companies are already well-positioned to help bolster the new security landscape since Russia’s invasion of Ukraine. With Germany set to double its annual defence budget and many others ramping up ambitions – including The Netherlands and Italy – the prospects will be favourable for many years to come.

Poland, Germany, France and the Czech Republic are four markets where opportunities are currently thriving. On October 23, 2025, the Ukrainian government made a milestone announcement as it issued a statement of intent to purchase upwards of 150 Gripen E fighter jets. If completed, it would be one of Saab’s single biggest deals.

Meanwhile, many small and medium sized Swedish specialists in everything from radar systems to cyber and security solutions are embracing the surge in European demand, and they are increasingly reaching out to Business Sweden for strategic guidance and practical support.

Niklas Grybe, Global Head of Defence, Business Sweden, at Sweden-Italy Defence Days in Rome, May 2025.

Q&A WITH NIKLAS GRYBE, GLOBAL HEAD OF DEFENCE AT BUSINESS SWEDEN

What are the most promising markets for Swedish defence companies right now, and how is Business Sweden helping them gain a foothold?

“Europe is clearly in focus driven by the war in Ukraine but also by the urgent need to rebuild a strong and independent defence. Sweden’s geography and role in NATO explains the importance of Finland, the Baltics and Poland.

The largest defense markets in Germany, the UK and France also provide opportunities given their size, growth and complementing capabilities. Besides Europe, the US, South America and Southeast Asia still offer lots of opportunities for many Swedish companies.

Business Sweden supports Swedish companies in many ways, typically by helping them gain access to networks, defence branches, authorities and industrial organisations. We also help them select the right markets and develop export strategies, where more than 4-5 markets are often addressed at the same time, and we invite them to participate in fairs and delegations.”

Dual-use technologies are becoming increasingly important. How can Swedish SMEs leverage this trend to enter the global defence supply chain?

“The gaps in the global defence sector mainly relate to transformative technologies across all the warfare domains which are reshaping the industry. Sweden's defence value chain has strong innovation capabilities and is well-placed to facilitate collaboration with the civil sector through dual-use technology.”

With defence budgets rising across Europe and beyond, what strategic advice would you give Swedish exporters to stay competitive in this new security landscape?

“Take a long-term perspective and focus on building trusted partners and suppliers to secure capacity and resilience over time. Acknowledge the need for local ownership of production and close control of supply chains. Pay attention to the specific needs and do not over-specify your solutions.”

Want to capture new opportunities in the global defence market? Contact Niklas Grybe to explore tailored strategies, navigate export regulations, and unlock partnerships that drive growth.