For years, Germany lagged behind other European countries, but recent fiscal policy shifts show renewed determination to close this gap. Of the 2025 allocation, EUR 2.9 billion is directed towards broadband expansion and EUR 263 million towards digitalising public administration. These investments aim to strengthen Germany’s competitiveness in the digital economy and to reduce bureaucratic burdens for citizens and businesses. Oversight rests with the country’s first Federal Ministry for Digital Transformation and Government Modernisation (BMDS).

Fibre rollout falls short

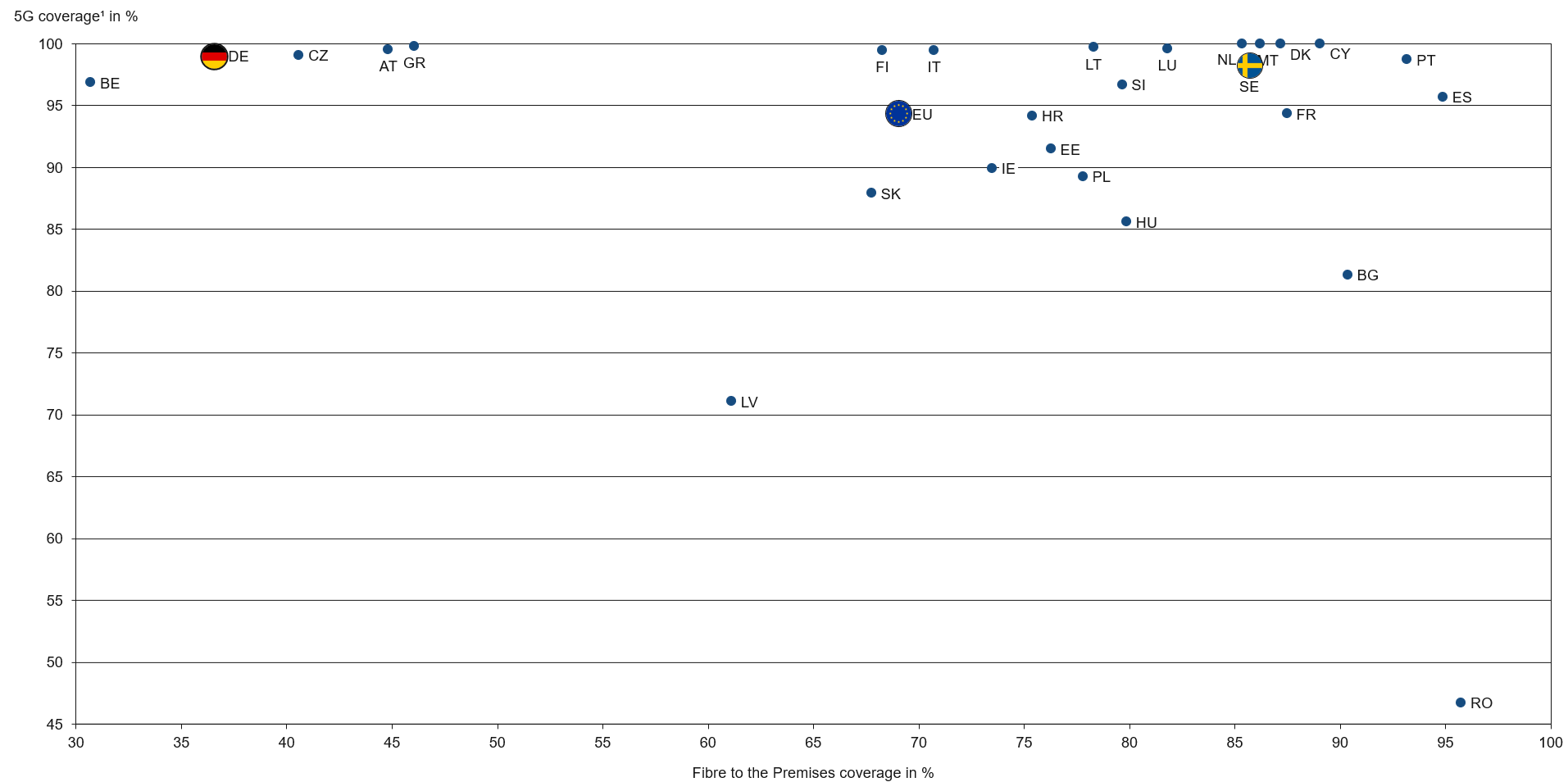

Germany aims for 100% Fibre to the Premises (FTTP) coverage by 2030, with 50% of households connected by 2025. By 2024, however, only 36.8% were covered – well below the EU average of 69.2% (Table 1). In contrast, 5G now reaches 99.1% of the population.

| Broadband coverage | Germany | EU | |||||

| 2023 | 2024 | Annual progress | Target by 2030 | 2024 | Annual progress | Target by 2030 | |

| Fixed Very High- Capacity Network (VHCN) coverage | 74.7% | 77.4% | 3.5% | 100% | 82.5% | 4.9% | 100% |

| Fibre to the Premises (FTTP) coverage | 29.8% | 36.8% | 23.4% | 100% | 69.2% | 8.4% | - |

| Overall 5G coverage | 98.1% | 99.1% | 0.9% | 100% | 94.3% | 5.9% | 100% |

Table 1: Digital infrastructures develop at different rates in Germany

Source: European Commission, Breitbandatlas

Germany’s broadband coverage, especially FTTP, ranks second to last among EU member states (Figure 1). Unlike countries such as Sweden, which began rolling out fibre in the late 1990s, Germany remained reliant on the copper-based DSL for many years, gradually introducing VDSL as a transitional solution before full fibre deployment. Consequently, fibre rollout was delayed until the late 2010s, creating a backlog in infrastructure expansion and investment.

Figure 1: Network coverage in 2025 comparing 5G and FTTP (Fibre to the Premises) coverage across the EU272 countries

1 Of at least one provider

2 AT-Austria, BE-Belgium, BG-Bulgaria, CY-Cyprus, CZ-Czechia, DE-Germany, DK-Denmark, EE-Estonia, ES-Spain, FI-Finland, FR-France, GR-Greece, HR-Croatia, HU-Hungary, IE-Ireland, IT-Italy, LT-Lithuania, LU-Luxembourg, LV-Latvia, MT-Malta, NL-Netherlands, PL-Poland, PT-Portugal, RO-Romania, SE-Sweden, SI-Slovenia, SK-Slovakia.

Source: European Commission

Launch of digital transformation initiative

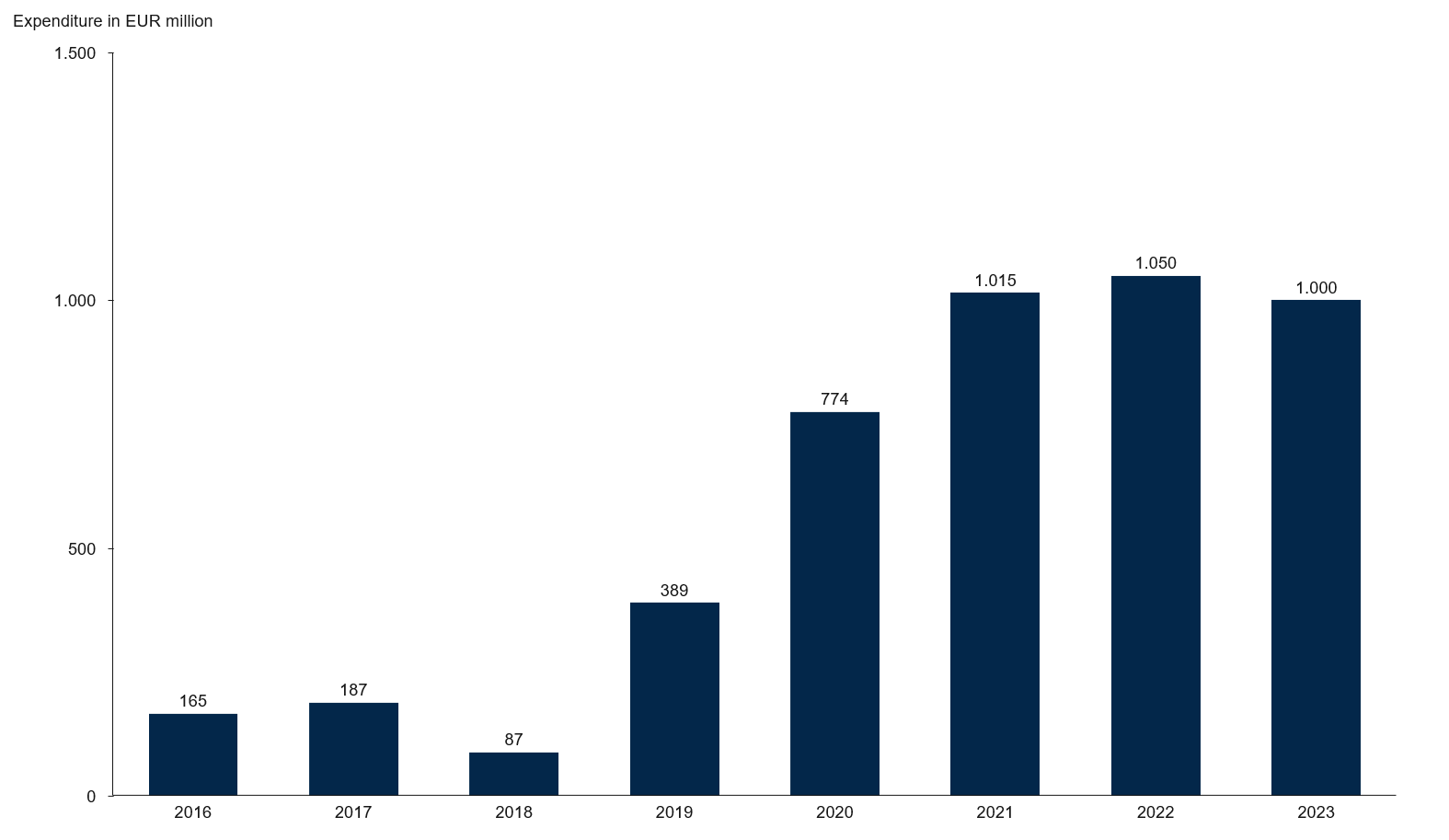

Germany’s investment backlog began to be addressed in 2018, when Chancellor Angela Merkel’s government established a EUR 2.4 billion Special Fund for Digital Infrastructure. The fund aimed to accelerate broadband rollout, especially in rural areas, and to support digital learning environments in schools. Following its introduction, investment levels in digital infrastructure increased significantly (Figure 2).

Figure 2: Federal public expenditure on digital infrastructure in Germany from 2016 to 2023, by type (in EUR million)

Source: Statista

The coalition under Chancellor Olaf Scholz, which took office in 2021, elevated digital infrastructure to a national priority and intensified support through additional funding. Alongside financial measures, recent consolidation efforts and better-coordinated strategies within the federal system have improved efficiency and targeting of resources.

A major milestone came in 2022 with the Federal Government’s Digital Strategy (Digitalstrategie), a framework for building a sovereign digital society, an innovative economy, and a modern digital state. Complementing this, the Gigabit Strategy (Gigabitstrategie) of July 2022 continues to guide measures to achieve nationwide gigabit connectivity and 5G rollout by 2030.

Public and private investment as a catalyst for growth

According to the July 2025 report Status of Fibre-Optic Expansion in Germany by the BMDS, private investment remains the primary driver of broadband rollout. Around 88.3% of fibre coverage has been delivered through commercially funded projects, while government initiatives account for 11.7%. Where private-sector expansion is not economically viable, the federal government supports deployment through the Gigabit Promotion 2.0 (Gigabitförderung 2.0) programme.

Complex and fragmented approval procedures

Approval requirements for fibre projects vary significantly between federal states and municipalities, creating administrative burdens for broadband providers. Smaller-scale projects are particularly affected, as lengthy and complex procedures undermine profitability and delay rollout.

To address these challenges, the Telecommunications Act (Telekommunikationsgesetz) was amended in June 2025. Expansion of mobile phone masts and fibre networks is now legally designated an overriding public interest – a move intended to accelerate deployment in underserved areas.

Investment Outlook

The Special Fund for Infrastructure and Climate Neutrality (SVIK) will further increase investments in 2025, allocating over EUR 4 billion to digital infrastructure. Of this, EUR 2.93 billion is earmarked for broadband rollout and EUR 366.8 million for mobile network expansion. Additional funds will support the digitalisation of public administration, including:

- EUR 263 million for register modernisation

- EUR 243 million for the citizen account and related infrastructure

- EUR 131 million for the European digital identity ecosystem

- EUR 45 million for transformation and IT services

According to the draft 2026 federal budget and fiscal plan to 2029, a further EUR 34.2 billion will be committed over the next four years, underlining the government’s intention to substantially scale up digitalisation funding (Table 2).

| Planned spending from the SVIK1 | 2025 | 2026 | 2027 | 2028 | 2029 |

| - in EUR billion - | |||||

| Digitalisation | 4.0 | 8.5 | 8.6 | 8.6 | 8.5 |

Table 2: Key figures for digital investments contained in federal budget 2026

1 Any discrepancies are due to rounding.

Source: Federal Ministry of Finance

The funds will be managed by the newly established BMDS and its first minister, Dr. Karsten Wildberger (CDU). The creation of this ministry is expected to boost the telecommunications and connectivity sector, advance new technologies, and improve network capabilities nationwide. Chancellor Friedrich Merz emphasised Wildberger’s mandate as a turning point: “We have given him the necessary powers and responsibilities, and through this ministry he will demonstrate that modernisation and digitalisation within a short period of time are possible in our country.”

Opportunities for Swedish companies

Business Sweden will closely monitor developments related to the Special Fund, which is set to trigger significant investment in digital infrastructure and administrative modernisation. Broadband expansion provides the foundation for future digital technologies, while further opportunities are expected in areas such as public administration modernisation, artificial intelligence, quantum technologies, and related fields. Sweden’s advanced digitalisation and expertise position Swedish companies as valued partners.

| Opportunity | ||

| Broadband Expansion | Expansion of FTTP coverage: construction, civil engineering, trenchless deployment methods, and last-mile connectivity solutions | |

| Provision of planning, permitting, and project management services to accelerate rollout | ||

| Training initiatives and AI-driven tools to address skilled labour shortages and streamline supervision | ||

Table 3: Key beneficiaries of SVIK

Source: Business Sweden

Next in the series

Our next post will explore Germany’s defense transformation, highlighting accelerated investments not only in infrastructure, cybersecurity, and intelligence services but also in the modernisation of the Bundeswehr, reflecting the country’s evolving role in European and transatlantic security.

Get in touch

Business Sweden supports companies entering Germany’s infrastructure and climate sectors. For advice on market entry, funding frameworks, or competitive bidding, please contact Johan Holmlund.

Sources

- European Commission (2025), DESI dashboard for the Digital Decade (2023 onwards), retrieved on 28/08/2025 from https://digital-decade-desi.digital-strategy.ec.europa.eu/datasets/desi/charts

- European Commission (2025), Germany 2024 Digital Decade Country Report, retrieved on 01/09/2025 from https://digital-strategy.ec.europa.eu/en/factpages/germany-2024-digital-decade-country-report

- Federal Ministry for Digital Transformation and Government Modernisation (2025), Bericht zum Stand des Glasfaserausbaus in Deutschland, retrieved on 01/09/2025 from https://bmds.bund.de/fileadmin/BMDS/Dokumente/Bericht-Glasfaserausbau-V10-SCREEN-BF-Maps-highres.pdf

- Federal Ministry of Finance (2025), Bundesregierung stellt finanzielle Weichen für die nächsten Jahre: Bundeshaushalt 2025, Eckwerte bis 2029 und Umsetzung des 500-Milliarden-Euro-Investitionspakets beschlossen, retrieved on 01/09/2025 from https://www.bundesfinanzministerium.de/Content/DE/Pressemitteilungen/Finanzpolitik/2025/06/2025-06-24-2-entwurf-bhh-2025-eckwerte-bis-2029.html

- Federal Ministry of Finance (2018), Gesetz zur Errichtung des Sondervermögens „Digitale Infrastruktur“ (Digitalinfrastrukturfondsgesetz – DIFG), retrieved on 01/09/2025 from https://www.bundesfinanzministerium.de/Content/DE/Gesetzestexte/Gesetze_Gesetzesvorhaben/Abteilungen/Abteilung_II/19_Legislaturperiode/Digitalinfrastruckturgesetz-DIFG/0-Gesetz.html

- Federal Ministry of Transport (2025), Umsetzung Gigabitstrategie, retrieved on 09/09/2025 from https://www.bmv.de/SharedDocs/DE/Artikel/DG/gigabitstrategie-des-bundes.html

- Federal Ministry of Transport and Digital Infrastructure (2025), Gigabitstrategie: Gigabit für alle!, retrieved on 01/09/2025 from https://www.bmv.de/DE/Themen/Digitales/Gigabitstrategie/Uebersicht-Gigabitstrategie/uebersicht-gigabitstrategie.html

- Federal Network Agency (2025), Digitales und Telekommunikation - Aktive Breitbandanschlüsse in Festnetzen, retrieved on 01/09/2025 from https://www.bundesnetzagentur.de/DE/Fachthemen/Datenportal/1_Digitales_Telekommunikation/_svg_TK/TK_Festnetz/Aktive Breitbandanschluesse/Aktive Breitbandanschluesse.html

- Federal Network Agency (2025), Breitbandatlas, retrieved on 01/09/2025 from https://gigabitgrundbuch.bund.de/GIGA/DE/Breitbandatlas/start.html