The ongoing Russian war of aggression against Ukraine and shifts in US foreign policy have fundamentally reshaped the European security landscape. As Europe’s most populous nation and largest economy, Germany is expected to take on greater responsibilities for collective defence. In line with NATO’s new capability targets – allocating 5% of GDP to defence by 2035, with at least 3.5% for core military expenditure and up to 1.5% for defence- and security-related spending – Germany is accelerating its military investments and modernisation of the Bundeswehr.

As Federal Minister of Defence Boris Pistorius emphasised, “We must reorient the focus of our Bundeswehr towards national and collective defence, and we must measurably increase its operational and deterrence capability – so that we may continue to live in freedom and peace.”

This transformation is supported by a temporary Bundeswehr special fund worth EUR 100 billion and a constitutional amendment that allows defence spending to exceed 1% of GDP through a suspension of the national debt brake. Together with the newly established Special Fund for Infrastructure and Climate Neutrality, these financial instruments provide Germany with the fiscal flexibility to modernise and expand its armed forces and infrastructure at speed.

Since Sweden acceded to NATO in March 2024, bilateral defence cooperation with Germany has deepened, driven by shared strategic priorities and a joint commitment to strengthening European security. As the official partner country at this year’s Berlin Security Conference, Sweden is represented by a high-level delegation led by Minister for Defence Pål Jonson and Minister for Civil Defence Carl-Oskar Bohlin, joined by 17 innovative Swedish companies. Prime Minister Ulf Kristersson and Minister for Gender Equality Nina Larsson are also in attendance. Organised by the Swedish Embassy and Business Sweden, the delegation is engaging with key German stakeholders to explore new opportunities for bilateral defence cooperation and innovation in Europe’s evolving security environment.

Defence industry strategy in Germany

On 4 December 2024, the German government adopted the National Security and Defence Industry Strategy (SVI Strategy). It aims to strengthen the national and European defence industries by fostering greater independence, self-reliance and innovation.

The strategy focuses on developing a dynamic, scalable and innovative industrial base that meets the Bundeswehr’s requirements quickly and reliably. “It is crucial for Germany’s defence capability to have our own innovative and efficient defence companies,” said Defence Minister Boris Pistorius. The strategy prioritises domestic promotion of key technologies and international cooperation to effectively close NATO’s capability gaps.

The SVI Strategy identifies several key challenges facing the security and defence industry:

- Security threats: Increased demands on deterrence, national defence, and advanced technologies

- Economic pressures: Rising financing needs, raw material dependencies, and global competition

- Regulatory barriers: Bureaucratic obstacles and export restrictions

- Innovation gaps: Limited synergies between civilian and military research

- Environmental challenges: Integrating sustainability into military production and operations

To address these, the government is implementing measures in six main fields of action:

- Strengthening key technologies and technological sovereignty (IT, AI, quantum tech, missiles, unmanned systems, ammunition)

- Linking civilian and defence-related R&D and supporting start-ups in dual-use innovation

- Ensuring resilient, diversified supply chains and promoting European procurement and cooperation

- Reducing bureaucracy, reforming procurement law, and streamlining export regulations

- Improving training, immigration policies, and working conditions to attract talent

- Securing access to capital and export credit guarantees

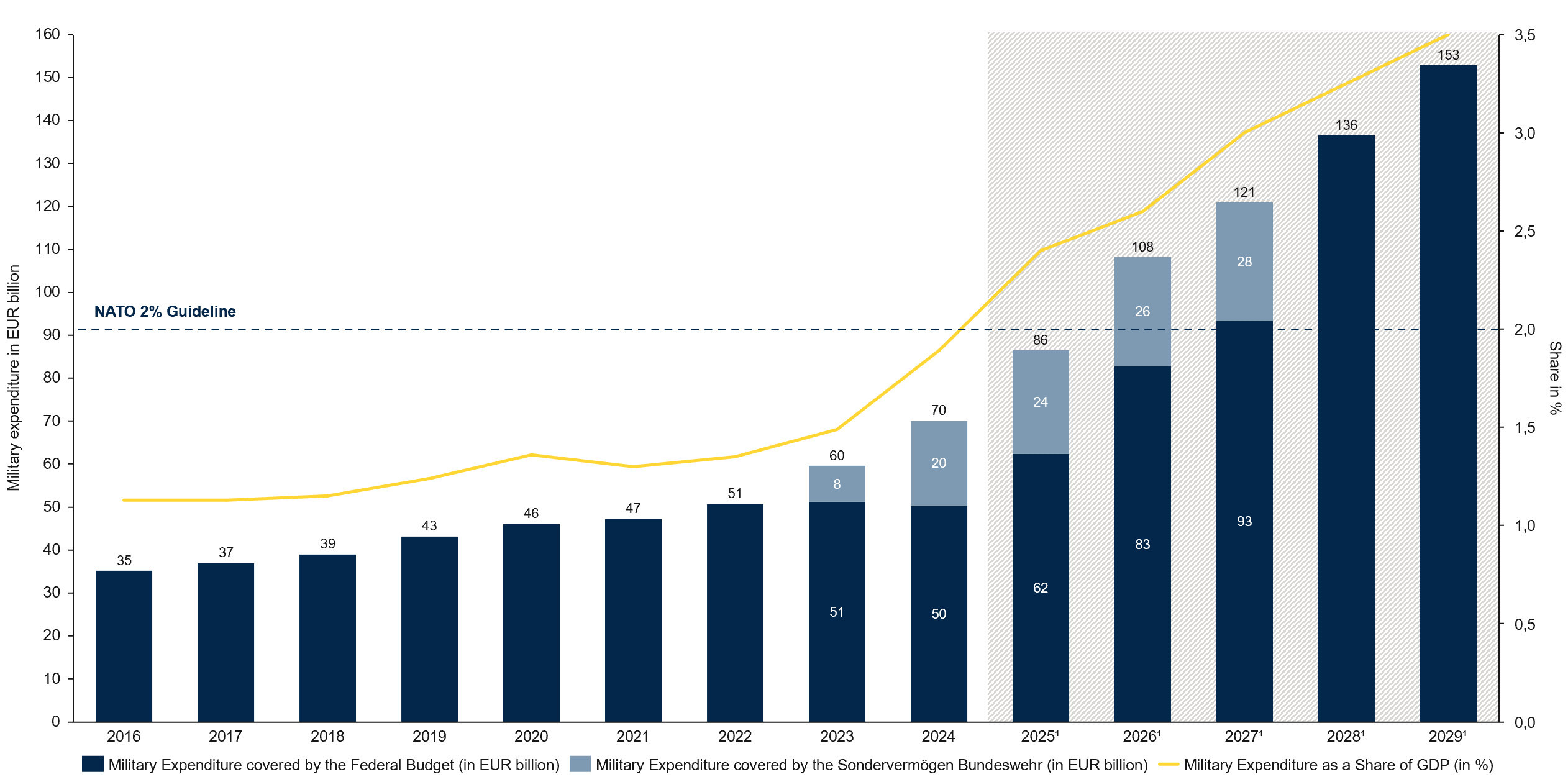

Launch of defence investment offensive

Germany’s defence spending has long fallen short of NATO’s 2% target, averaging only 1.2% of GDP over the past decade. In 2014, the NATO members committed to meeting this benchmark within 10 years. Despite a gradual increase, from EUR 35.1 billion (1.13 %) in 2016 to EUR 51.2 billion (1.49 %) in 2022, Germany’s ability to address emerging security challenges remained limited (Figure 1). Without new financing, total defence expenditure in 2024 would have reached only 1.7% of GDP, leaving a EUR 13 billion gap relative to NATO’s target and reflecting decades of cumulative underinvestment totalling EUR 618 billion since 1989.

Figure 1: Military expenditure as a share of GDP and in absolute monetary values

1 Projection

Source: Statista (2025)

The Zeitenwende, or turning point, came three days after Russia invaded Ukraine in February 2022. Then-Chancellor Olaf Scholz announced a historic shift in Germany’s security policy, launching a EUR 100 billion special fund to modernise military capabilities and committing to invest more than 2% of GDP in defence annually.

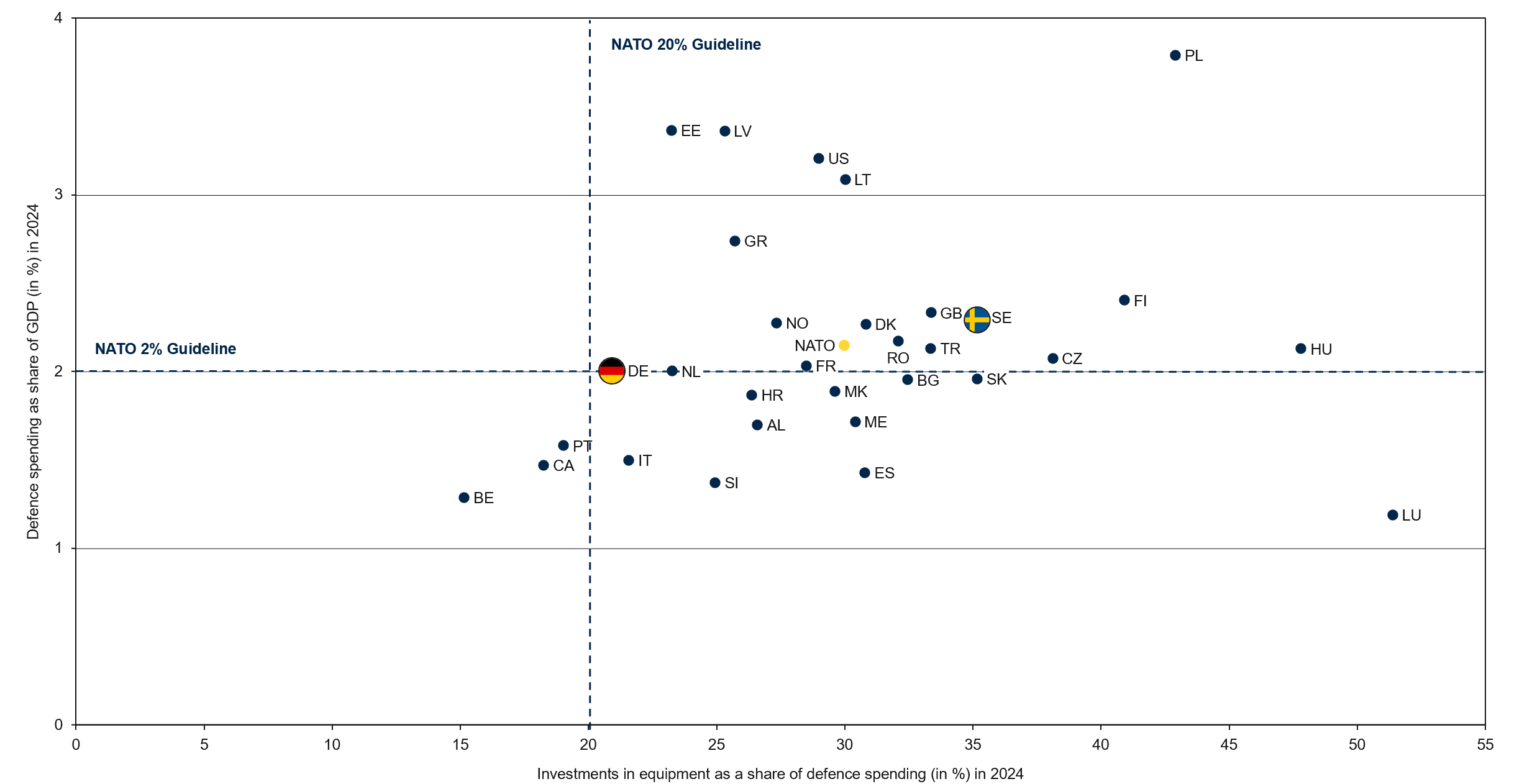

In 2023, EUR 8 billion was allocated from the fund for key procurement programmes and advanced air defence systems. In 2024, Germany’s regular defence budget was supplemented by EUR 20 billion from the fund, marking the first time since 1991 that NATO’s dual targets (2% of GDP on defence and 20% of investments on equipment) were met (Figure 2).

Figure 2: Defence spending1 as a share of GDP vs. equipment investments, as a share of total defence spending of NATO members2 in 2024

1 Includes military and civil personnel, operation and maintenance, procurement, military research and development, infrastructure, and aid.

2 AL–Albania, BE–Belgium, BG–Bulgaria, CA–Canada, HR–Croatia, CZ–Czechia, DK–Denmark, EE–Estonia, FI–Finland, FR–France, DE–Germany, GR–Greece, HU–Hungary, IT–Italy, LV–Latvia, LT–Lithuania, LU–Luxembourg, ME–Montenegro, NL–Netherlands, MK–North Macedonia, NO–Norway, PL–Poland, PT–Portugal, RO–Romania, SK–Slovak Republic, SI–Slovenia, ES–Spain, SE–Sweden, TR–Türkiye, GB–United Kingdom, US–United States

Source: NATO (2025)

As the Bundeswehr special fund is expected to be fully utilised by 2027, the new government introduced reforms of the constitutional debt brake and created the Special Fund for Infrastructure and Climate Neutrality (SVIK). The debt brake exemption for defence spending above 1% of GDP (from 2025) enables increased regular appropriations alongside the special fund. As Chancellor Merz stated, the goal is to make the Bundeswehr “the strongest conventional army in Europe.”

The SVIK will contribute to NATO’s goal of allocating 1.5% of GDP to infrastructure investment. Germany’s total defence budget is projected to surpass EUR 152.8 billion by 2029, reaching 3.5% of GDP that year.

Allocation of Bundeswehr special fund

All revenues and expenditures from the Bundeswehr special fund must be reflected in an economic plan detailing the authorised commitments (Verpflichtungsermächtigungen). For 2025, approximately EUR 24.06 billion is allocated, a record level of defence investment (Table 1). The largest share supports procurement of aircraft, tanks, missiles, and ammunition, along with significant funding for digitalisation, AI, quantum technologies, unmanned systems, and satellite communications.

| Category | 2025 Expenditures (in EUR million) | Change vs. 2024 (in EUR million) | |

| 1. | Defence Research & Technology | 958 | +291 |

| 2. | Military Procurement | ||

| 2.1. | Clothing & Equipment | 740 | -87 |

| 2.2. | Command & Digitalisation | 4,198 | +1,578 |

| 2.3. | Land (Tanks & Vehicles) | 4,412 | +1,825 |

| 2.4. | Sea (Ships & Marine Equipment) | 2,681 | +485 |

| 2.5. | Air (Aircraft & Helicopters) | 10,248 | +242 |

| 3. | Construction Projects | 774 | +624 |

| 4. | Replacement / NATO Contributions | 520 | +520 |

| Total Expenditures | 24,060 | +4,260 | |

Table 1: Allocation of the Bundeswehr special fund in 2025

Source: Federal Ministry of Finance

Cross-sector market opportunities

The defence sector increasingly benefits from synergies with other industries, generating cross-sector market potential. Several key sectors, including construction and infrastructure, energy and environment, logistics and supply chain management, IT and cybersecurity, health and pharmaceuticals, and the automotive industry, offer technologies and expertise that strengthen defence capabilities. Table 2 highlights key focus areas where cross-sector innovations and resources support the modernisation and operational effectiveness of the Bundeswehr and allied forces.

| Sector | Description | Potential | Cross-sector opportunity |

| Construction and Infrastructure | Growing demand for barracks, ammunition depots, IT centres, and training facilities | Construction contracts worth billions; expertise in building construction, civil engineering, and specialised construction | Construction of protected infrastructures (e.g. resilient data cables that can withstand disruptions) |

| Energy and Environment | Defence requires energy security (e.g. autonomous power supply on deployment bases) | Mobile generators, water purification systems, and CO2-neutral propulsion technologies | Climate protection and resilience measures are strategically relevant (e.g. noise-reduced electric mobility) |

| Logistics and Supply Chain Management | Resilient, protected supply chains are crucial for operational readiness | Secure logistics, real-time tracking, cyber-resilient supply chains | Dual-use of civilian logistics platforms, especially to support military mobilisation efforts |

| IT and Cybersecurity | Hybrid attacks and cyber warfare pose growing threats | Software for attack detection, encryption technologies, and red-teaming | Collaboration with civilian Computer Emergency Response Teams (CERTs) and protection of critical infrastructures |

| Health and Pharmaceuticals | Military healthcare and pandemic preparedness are essential | Medical supplies, mobile stations, and strategic stockpiles of medications | Lessons learned from the Covid-19 pandemic have elevated health security to an important defence policy issue |

| Automotive | Mobility and robotics expertise transferable to defence applications | Chassis and suspension systems, electric mobility, and modular platforms for drones and robots | Access to skilled personnel, manufacturing lines, and testing infrastructure |

Table 2: Cross-sector market opportunities

Source: Handelsblatt (2025)

Next in the series

Our next post will explore Germany’s energy infrastructure and its transformation towards climate neutrality by 2045, covering renewable energy expansion, hydrogen technologies, and investment trends under the SVIK and Climate Transformation Fund (KTF).

References

- Bundesministerium der Finanzen (2025), Einzelplan 14 – Verteidigung (Entwurf), retrieved on 19/10/2025 from https://www.bundeshaushalt.de/static/daten/2025/soll/draft/epl14.pdf.

- Bundesministerium der Finanzen (2025), Weichenstellungen in der Finanzverfassung: Ein Finanzierungspaket für Sicherheit und Investitionen, retrieved on 19/10/2025 from https://www.bundesfinanzministerium.de/Monatsberichte/Ausgabe/2025/04/Kapitel/kapitel-2a-finanzierungspaket.html.

- Bundesministerium der Verteidigung (2023), Integrierte Sicherheit für Deutschland, retrieved on 21/10/2025 from https://www.nationalesicherheitsstrategie.de/National-Security-Strategy-EN.pdf.

- Bundesministerium der Verteidigung (2024), Nationale Sicherheits- und Verteidigungsindustriestrategie, retrieved on 21/10/2025 from https://www.bmvg.de/resource/blob/5873628/138fddf8112609dfdc3ea44a52ba9195/dl-national-security-and-defence-industry-strategy-data.pdf.

- Bundesministerium der Verteidigung (2025), Deutlicher Anstieg des Verteidigungshaushalts ab 2025, retrieved on 20/10/2025 from https://www.bmvg.de/de/presse/deutlicher-anstieg-des-verteidigungshaushalts-ab-2025-5958092.

- Deutscher Bundestag (2025), Haushalt 2025: Verteidigungsetat auf neuem Höchststand, retrieved on 20/10/2025 from https://www.bundestag.de/presse/hib/kurzmeldungen-1107332.

- Deutscher Bundestag (2025), Unterrichtung durch die Wehrbeauftragte Jahresbericht 2024 (66. Bericht), retrieved on 12/10/2025 from https://dserver.bundestag.de/btd/20/150/2015060.pdf.

- Handelsblatt (2025), Think Defence – Einstieg in den Verteidigungsmarkt.

- North Atlantic Treaty Organisation (2025), Defence Expenditure of NATO Countries (2014–2025) [dataset], retrieved on 21/10/2025 from https://www.nato.int/nato_static_fl2014/assets/pdf/2025/8/pdf/250827-def-exp-2025-en.pdf.