The coronavirus pandemic poses a severe threat to human health and the global economy. China is gradually getting on the path to recovery, but Swedish companies operating in the market will continue to suffer from the consequences of the outbreak.

Together with the Swedish Chamber of Commerce in China, Business Sweden has carried out a flash survey to track the business impact of the Covid-19 pandemic which is being felt across the country. Apart from the extreme measures taken to contain the outbreak and protect public health, a series of initiatives and incentive programmes have been launched by the Chinese authorities as well as companies and organisations with a view to kickstart the economy.

These measures include 5G infrastructural investments, financial support packages for SMEs and promotion of foreign investments. The spread of coronavirus in China appears to be under control and few new cases are being reported. The biggest threat is now imported cases from other countries which could trigger a second infection wave. This has led to the implementation of strict controls at most entry points, with mandatory quarantine being required for anyone arriving from abroad.

Containment of the virus versus economic growth is a fine balancing act, which is reflected by our latest survey results.

Impact on sales remains, while production outlook is more positive

Production is gradually restarting

When China’s workers returned from the Spring Festival in early February, travel restrictions, closed offices and factories that couldn’t restart had an immediate short-term effect, as noted by the sharp drop when stock exchanges opened on February 3.

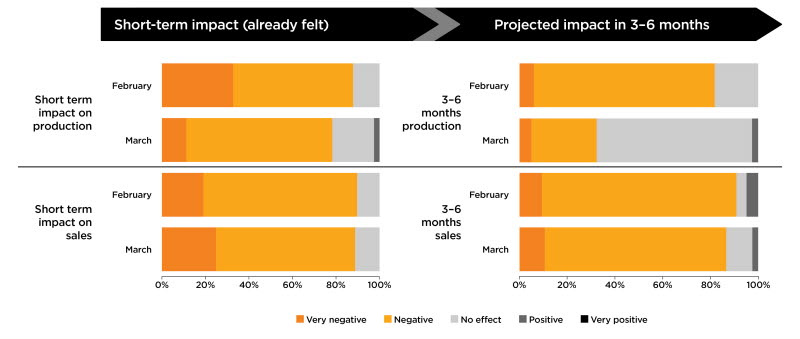

Compared to our survey conducted a month ago, in mid-February, Swedish companies are now reporting a less negative impact on production: 78% of companies are feeling a negative or very negative immediate impact (compared to 88% in February), and only 32% are forecasting a negative or very negative impact over the next 3 to 6 months (82% in February).

Availability of personnel is the key issue for production

Q: What are the main factors impacting your company's ability to produce?

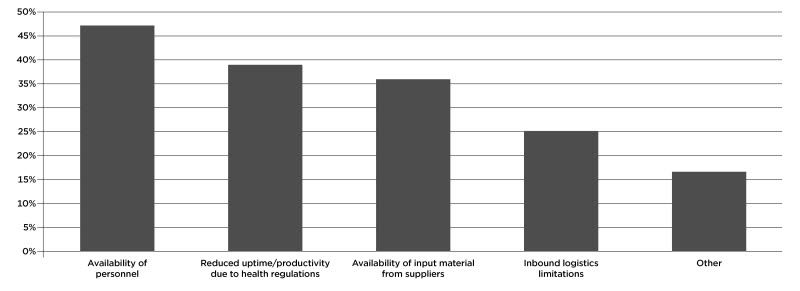

When asked which factors are having the most severe business impact, Swedish companies reported:

- Availability of personnel (47%)

- Reduced uptime/productivity due to health regulations (39%)

- Availability of input material from suppliers (36%)

Although most factories outside of Hubei province have resumed operations, many of them are not running at full capacity yet. At the same time, the survey shows that significant improvements can be expected in the coming months.

Demand forecast remains week

More troublesome for Swedish companies is the reduced demand for their products. 89% of the respondents (90% in Feb) are feeling a negative or very negative impact on sales. In terms of sales forecasts, the outlook is only slightly brighter today: 86% (90% in Feb) are projecting a negative or very negative sales impact over the next 3 to 6 months.

Travel restrictions combined with demand drop are the most dominant factors impacting sales

Q: What are the main factors impacting your company's ability to sell?

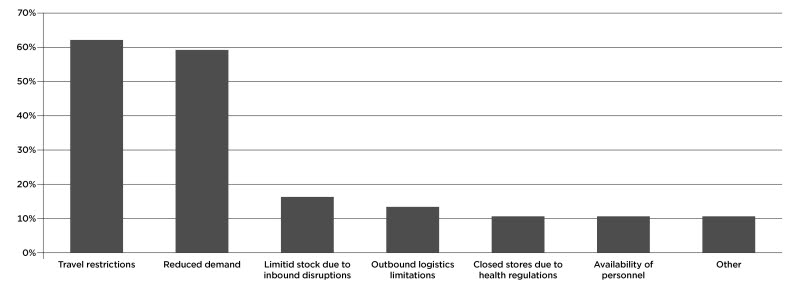

The two dominant factors impairing Swedish companies’ ability to sell are:

- Travel restrictions (62%)

- Reduced demand (59%)

The first factor is likely to ease over the coming months as other global markets gradually get the situation under control. But addressing the limited demand due to reduced economic growth is more challenging. It will therefore be critical that companies continue to stay as agile as possible and adapt to shifting pockets of demand in China and elsewhere.

Travel restrictions have become the new norm

When asked which measures Swedish companies are implementing to mitigate health risks posed by the coronavirus spread, the top three were:

- Limited travelling (86%, up from 76% in Feb)

- Alternative working arrangements (76%, down from 86% in Feb)

- Adjusted health routines (65%, up from 32% in Feb)

Work practices are gradually being normalised, even though a majority of companies are still choosing alternative set-ups with flexible hours and working from home solutions.

As more people flow back into offices and factories, stricter health and sanitation routines are now required. The spread of Covid-19 has also led to further restrictions on travelling. Besides the obvious impact on the travel industry, this also seems to affect sales across industries: reduced travel was reported as the number one reason for the negative impact on sales.

The survey results clearly show that the need to strike a balance between virus containment and economic growth will be a delicate path going forward, which both authorities and companies will need to navigate carefully.

Supply alternatives are limited

Companies are starting their economic recovery as the immediate health risk is getting under control. A number of initiatives are being taken to mitigate losses and adapt operating models. The most prevalent of these are focused on operational acceleration combined with delayed capital expenditure:

- Increasing sales and production plans from Q2 onwards (49%, up from 38% in Feb)

- Postponement of planned investments (35%)

- Diversifying supply chain (24%, down from 33% in Feb)

- Shifting work to other offices/sites (19%, down from 24% in Feb)

Steps to shift the geographical allocation of work and resources had already emerged when our previous survey in February was carried out. But with more markets outside China now being affected by the virus, the options for choosing alternative supply chains have narrowed, as demonstrated by the slight drop in these types of actions.

Speed of recovery remains uncertain

China is seeing the light in the tunnel when it comes to responding to Covid-19. But the world economy is closely interconnected, and many Swedish companies operate in a global context with global organisations, supply chains and customer bases.

The coronavirus outbreak is a black swan event in the economy and recovery is still a moving target as the situation continues to unfold. Our inability to predict the future does not mean that we should ignore it. Regardless of the industries that companies operate in, taking a scenario-based approach to business planning and risk mitigation is now critical. Companies need to be agile and adapt to rapid changes on both the supply and demand side of their business.

We will all get out of the tunnel in one way or another. The shape that companies will be in when arriving on the other side is still, unfortunately, very much an open question.

The survey was conducted among the members of the Swedish Chamber of Commerce in China with 37 participants representing SMEs and large companies across several business sectors.

Contact:

Joakim Abeleen, Market Area Director, Greater China, Business Sweden, Tel +86 139 1154 3630, joakim.abeleen@business-sweden.se

Daniela Ling-Vannerus Cassmer, Swedish Chamber of Commerce China (SwedCham China), Beijing, Tel: +86 10 646 85 820, beijing@swedcham.cn